The Asan Karobar Scheme, started by Punjab Chief Minister Maryam Nawaz, is a game-changing program designed to support small and medium businesses and improve the economy. Through this scheme, people can get interest-free loans, enjoy business-friendly rules, and even receive solar systems to help grow their businesses.

If you want to take advantage of this amazing opportunity, keep reading to learn how to register and all the benefits this scheme offers.

Key Features of the Asan Karobar Finance Scheme

- Loan Amount: You can get interest-free loans between Rs. 500,000 and Rs. 30 million.

- Easy Installments: Pay back the loan in simple, affordable installments.

- No Special Documents Needed: You don’t need NOCs, licenses, or map approvals to apply.

- Land and Solar Systems: Get subsidized land and free solar systems worth up to Rs. 5 million for businesses in export zones.

- Online Application: You can easily apply online through the official website.

This scheme is designed to make it easier for everyone to start or grow their business.

Details of the CM Punjab Loan Scheme

Loan Type | Amount Range | Purpose |

Asan Karobar Card | Rs. 5 lac–1 million | Small business setup and expansion |

Asan Karobar Finance Loan | Rs. 1 million–30 million | Medium to large-scale business financing |

Eligibility for AKF Asaan Loan

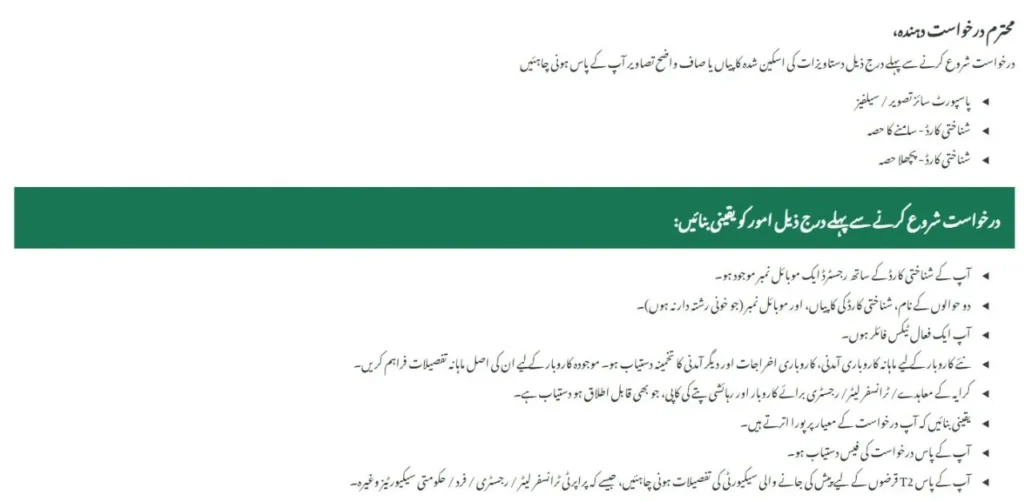

Additional Requirements for the AKF Asaan Loan Application

Before applying for the Asaan Business Loan, make sure you meet these requirements:

- A mobile number that is registered with your CNIC.

- Names, CNIC copies, and phone numbers of two references (not family members).

- You must be an active tax filer.

- Provide details of your business income and expenses if applicable.

- A copy of your Rent Agreement, Transfer Letter, or Property Registry for your business and home address (whichever applies).

- Make sure you meet all the application criteria.

- You will need the application fee ready.

- If applying for T2 Loans, provide details of the security you’ll offer, like a Property Transfer Letter, Registry, Fard, or Government Securities.

Be sure you have everything in order before starting your application.

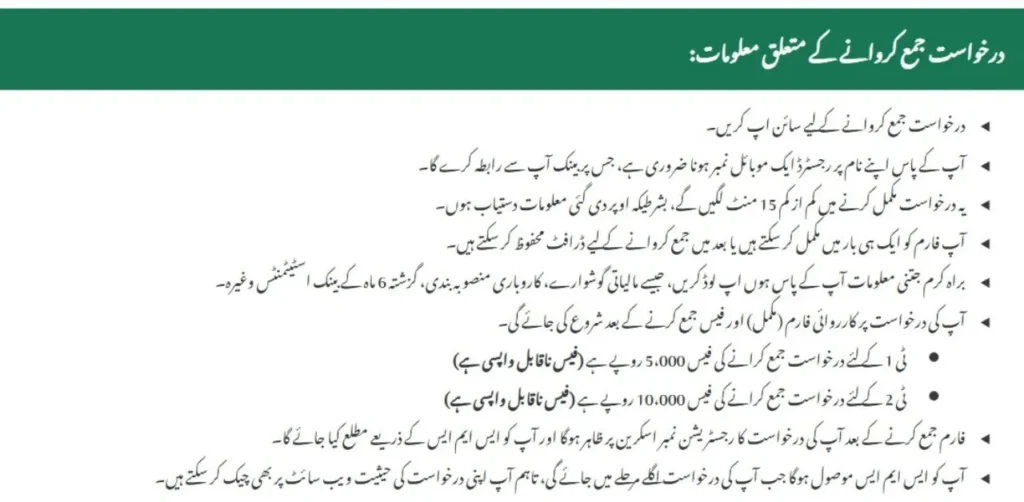

About the Application Submission:

- To apply: You need a mobile phone number registered in your name.

- Time: The application takes around 15 minutes to complete.

- Save your work: You can save your application and finish it later.

- Include information: Add as much information as possible, like your financial records and your business plan.

- Application fee: There’s a fee to apply, which is 5,000 rupees for Tier 1 and 10,000 rupees for Tier 2. This fee cannot be refunded.

- Application number: After submitting, you’ll receive an application number.

- Updates: You’ll get updates about your application through SMS messages.

- Check online: You can also check the status of your application online.

Also apply for: Apply Today: Best Supervisor Jobs in Rawalpindi

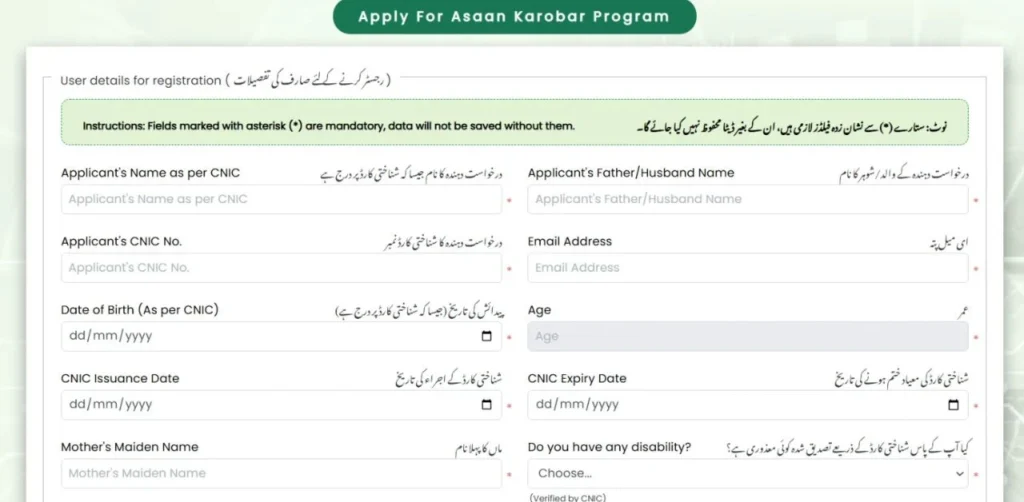

Follow these easy steps to register for the Asan Karobar Scheme online:

Here’s how you can apply for the Asan Karobar Scheme in simple steps:

- Visit the Official Website: Go to akf.punjab.gov.pk.

- Fill Out the Application: Enter your basic details like name, CNIC, and contact information. Choose the loan type and purpose.

- Submit Documents: Upload your documents (no NOCs or licenses needed).

- Get Help: If you need help, call the helpline at 1786.

- Approval and Funds: Once approved, you’ll get your loan directly from the Bank of Punjab.

It’s a quick and easy process to get the support you need.

AKF Punjab Login

To log in to the AKF Punjab website, you need two things:

- Your National CNIC Number

- Your Login Password

Benefits of the Scheme:

- Supports Entrepreneurs: Helps small and medium businesses grow, which are the heart of the economy.

- Quick Start: Apply today, and you can start your business tomorrow!

- Interest-Free Financing: No extra cost from interest payments.

- Boosts the Economy: Helps reduce unemployment and improves economic stability.

It’s an easy way to get support for your business.

What Is the Amount Given for the Asan Karobar Card?

The Asan Karobar Card offers a loan amount ranging from Rs. 10 lakh to Rs. 3 crore, which you’ll receive after completing the registration process.

Final Thoughts

The Asan Karobar Scheme is a great opportunity for entrepreneurs in Punjab. With interest-free loans, an easy application process, and extra benefits like solar systems and discounted land, it can really help small and medium businesses grow.

Don’t miss out on this chance register today and get the funding you need to start or grow your business. For more details, visit the official website or call 1786.

FAQs

What if I need help with the application?

No worries! If you face any issues, you can call the helpdesk at 1786 for guidance. They’re ready to assist you every step of the way.

Can I apply for the scheme if I don’t have a big business?

Yes This scheme is meant to help small businesses grow. Whether you’re just starting or looking to expand, you can apply.

How long will it take to get the loan after applying?

Once your application is approved, the loan amount is disbursed directly to your bank account. The whole process is fast, so you can get started on your business right away.